What is it?

Credit cards are thin, rectangular pieces of plastic or metal provided by a bank or financial services business that enable cardholders to borrow money to buy goods and services from merchants who accept cards. They require cardholders to repay the borrowed money, interest, and any extra charges by the billing date or over time.

Credit cardholders may get a cash line of credit (LOC) in addition to the usual credit line, allowing them to borrow money for cash advances via bank tellers, ATMs, or credit card convenience checks. Cash advances with no grace period and higher interest rates have different terms than those that access the primary credit line. Issuers usually establish borrowing restrictions based on credit scores. Credit cards, one of the most common payment methods for consumer products and services, are accepted by most establishments.

Understanding Credit Cards

Credit cards have higher APRs than other consumer borrowing. Unpaid card balances are usually charged interest one month after a purchase (unless there is a 0% APR introductory offer for an initial period after account opening), unless previous unpaid balances were carried forward from a previous month.

The rule requires credit card issuers to inform customers at least 21 days before charging interest on transactions.

When feasible, pay off bills before the grace period ends. Understanding whether your issuer accrues interest daily or monthly is vital since the former results in larger interest rates for unpaid balances. This is crucial if you want to move your credit card debt to a lower-interest card. Mistakenly converting from a monthly accrual card to a daily one might negate lower rate savings.

How Do Credit Cards Work?

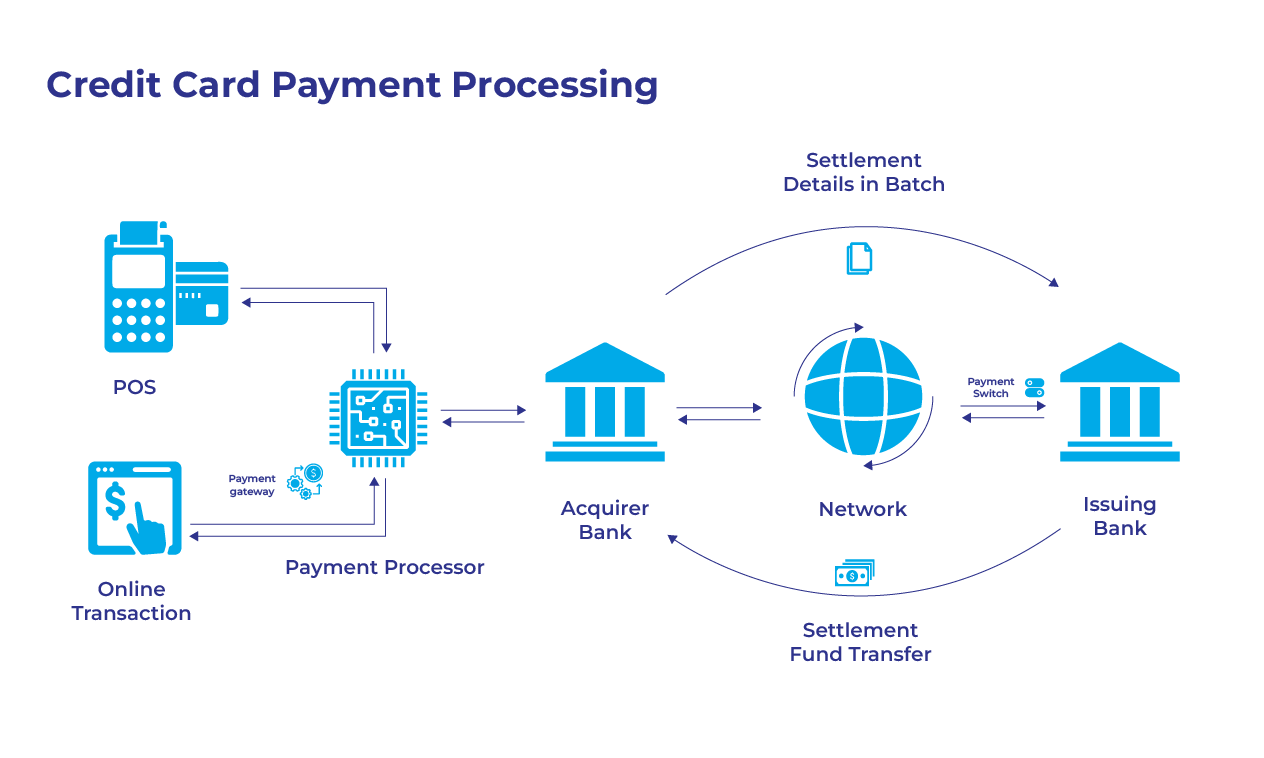

Process for accepting credit cards?

Customers provide their payment information, such as:

- A card reader at a POS or terminal is used in-person, whereas an e-commerce store’s hosted payment form is used online.

- By phone or mail.

- Before paying, customers provide their credit cards. The payment processor secures and encrypts credit card data before sending it to the authorization network.

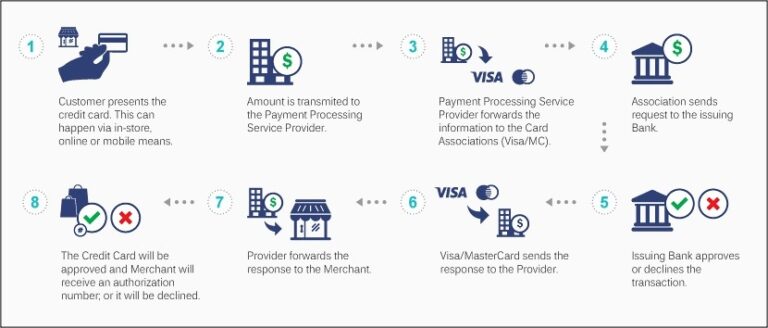

After the processor receives the payment information and connects with the customer’s bank via card networks, the transaction is accepted or rejected based on validity and funds.

The payment processor will send approved transactions back to the POS, terminal, or credit card reader to finalize the sale. At the conclusion of each working day, transactions are batched for settlement.

Declined transactions will not be executed, thus the cardholder must use another method to pay.

- A credit card is defined as a plastic or digital card that enables you to borrow money for purchases, cash advances, and balance transfers up to a certain amount.

- Issuer: Typically, financial institutions or banks.

Who’s Important in Credit Card Processing?

- The Client: Credit card processing starts when a cardholder swipes or gives payment information to the merchant.

- The Merchant: The merchant accepts and collects payment information in two ways: physically by accepting payments from the cardholder, called Card Present Transactions, and online, called Card Not Present (CNP) Transactions processed through a gateway.

- The Processor: The credit card processor receives payment information and routes it through several stages and facilitates communication.

- Card Network: The customer’s card will use Visa or MasterCard. After receiving information from the processor, the card network sends it to the bank.

- The Customer’s Bank: The cardholder’s bank checks the payment request and ensures the cardholder has enough money to buy. The bank will reject the transaction if the cardholder lacks money.

- The Merchant: Once the transaction is cleared, the merchant must provide the products and services.

Processing costs for credit cards

Credit card settlement and processing are notoriously complicated. The price for ease is credit card processing fees. This sum is levied to the merchant by his payment processor.

Payment processors like fintech companies that supply the selling platform’s payment infrastructure earn this charge. It is then sent to other credit card processors.

Credit card processing costs are divided.

- Interchange: Non-negotiable issuing bank commission.

- Assessments: Non-negotiable card network brand commission.

- Markup: Negotiable payment processor commission.

Credit Card Types

- Credit cards that are standard issuers and lack any unique characteristics.

- Cards that provide prizes, such as points or cash back, are known as rewards cards.

- Cards with low interest rates for balance transfers are known as balance transfer cards.

- Secured credit cards are ones that need a security deposit and are often offered to those with bad credit or no credit history.

Pros and Cons

- Advantages: Easy access, incentives, credit building, and purchasing security.

- Cons: High interest rates, fees, and debt potential.

FAQ

- What impact does a credit card have on my credit rating? Talk about how prudent use may improve credit, while late payments can hurt it.

- Can I use my credit card to make cash withdrawals? A description of cash advances and the costs involved.

- If my credit card is stolen or misplaced, what should I do? How-to guides for reporting and account security.

Recap the features of credit cards and their place in personal finance in the conclusion summary.

Suggestion: Promote appropriate use and comprehension of the terms and conditions.